That leaves at least $11 billion annually it can use for acquisitions like Activision Blizzard. Therefore, its cash outlays are about $49 billion for dividends and buybacks, but its cash inflow from FCF is $60 billion. The dividend payments cost about $18.6 billion annually (i.e., $2.48 DPS x 7.508b shares outstanding).ħ Utility Stocks to Buy Despite the Heating Crisis

The dividend will cost about In addition, Microsoft has $131.6 billion in cash and short-term investments on its balance sheet. This gives MSFT stock a total yield of about 2.2% (i.e., 1.35% dividend yield + 0.838% buyback yield) annually.ĭespite Microsoft’s recent $69 billion cash acquisition of Activision Blizzard (NASDAQ: ATVI), Microsoft will have plenty of cash and FCF to afford the buybacks.įor example, my recent article on Microsoft shows that its annual FCF is about $60.4 billion. In addition, its dividend yield, based on its $2.48 dividend per share (DPS) is 0.838% (i.e., $2.48/$296.03 price).

#NVDA DIVIDEND PAYOUT PER SHARE SOFTWARE#

Moreover, the large software company looks set to buy back about 1.35% of its market annually (i.e., 2.7% of market cap/2 years). So look for good things to happen with Apple stock over the next five years with its dividend and stock buyback programs. This assumes its “hardware revenues do not decline and its service segment grows at historical mid-teens,” according to Sacconaghi. So, between the higher dividends and lower share count, AAPL stock has a good chance of moving at least 13% to 15% higher each year, as a minimum, before any multiple expansion.Īnother reason for this is that the share count will increase the earnings per share (EPS). Here is his amazing conclusion, according to Barron’s:Īpple could continue buying back between 3% and 4% of its shares each year through 2026-while growing its dividend 10% a year-without taking on any net debt on its balance sheet.Īs a result, its total share count can be forecast as falling by 15% over the next five years, according to the analyst. this is along with its regular dividend payments.

#NVDA DIVIDEND PAYOUT PER SHARE FREE#

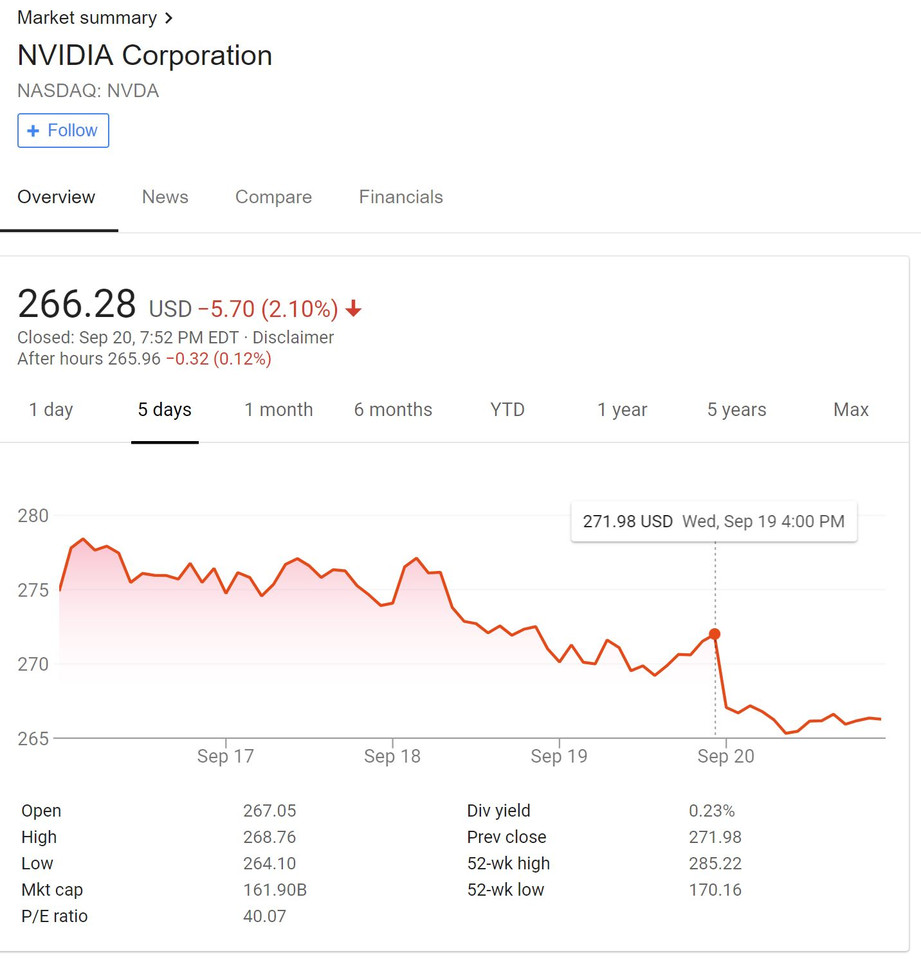

He wrote that Apple has returned 100% of the company’s free cash flow (FCF) in the past four years. 2021 Barron’s magazine referenced a research note written by Bernstein analyst Toni Sacconaghi on AAPL share repurchases. Dividend Yield % measures how much a company pays out in dividends each year relative to its share price.In Nov. And the median was 15.60% per year.įor more information regarding to dividend, please check our Dividend Page.ĭuring the past 13 years, the highest Dividend Payout Ratio of NVIDIA was 0.42. You can apply the same method to get the average dividends per share growth rate.ĭuring the past 13 years, the highest 3-Year average Dividends Per Share Growth Rate of NVIDIA was 73.90% per year. Please click Growth Rate Calculation Example (GuruFocus) to see how GuruFocus calculates Wal-Mart Stores Inc (WMT)'s revenue growth rate. NVIDIA Corp stock dividend yield is close to 2-year high.ĭuring the past 3 years, the average Dividends Per Share Growth Rate was 1.60% per year.ĭuring the past 5 years, the average Dividends Per Share Growth Rate was 5.20% per year. As of today, NVIDIA's Dividend Yield % is 0.13%. Its dividends per share for the trailing twelve months (TTM) ended in Jul.

Margin of Safety % (DCF Earnings Based).Float Percentage Of Total Shares Outstanding.

0 kommentar(er)

0 kommentar(er)